kaufman county tax rates

Your property tax burden is determined by your locally elected officials. A convenience fee of 229 will be added if you pay by credit card.

Meeting Name Date Agenda Introductions Transportation Funding 101 Program Development Process Program Projects Strategic Funding Tax Rate Implications Ppt Download

The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code.

. The median property tax also known as real estate tax in Kaufman County is 259700 per year based on a median home value of 13000000 and a median effective property tax rate of. History of Tax Rates. Understanding the Property Tax Process.

The current total local sales tax rate in Kaufman TX is 8250. What is the sales tax rate in Kaufman County. Please try again later.

This rate includes any state county city and local sales taxes. The December 2020 total local sales tax rate was also 8250. County and state tax.

Our property tax data is based on a 5-year study of median. The minimum convenience fee for credit cards is. Kaufman County Tax Assessor August 18.

Search could not be preformed at this time. Mud4 kaufman county mud 11 0410000 0590000 1000000 mud5 kaufman county mud 12 na na na mud6 kaufman county mud 5 0067500 0932500 1000000 mud7 kaufman county. The minimum combined 2022 sales tax rate for Kaufman County Texas is.

Texas has a 625 sales tax and Kaufman County collects an additional. The Texas Constitution requires local taxing units to make taxpayers aware of tax rate proposals and to afford. To pay by telephone call 1-866-549-1010 and enter Bureau Code 5499044.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code. Our Kaufman County Property Tax Calculator can estimate your property taxes based on similar properties.

2020 rates included for use while preparing your income tax deduction. Kaufman County collects on average 2 of a propertys assessed. The latest sales tax rate for Kaufman County TX.

Kaufman Reappraisal Plan 15-16. This is the total of state and county sales tax rates. Whether you are already a resident or just considering moving to Kaufman County to live or invest in real estate estimate local property.

The median property tax in Kaufman County Texas is 2597 per year for a home worth the median value of 130000. Low Income Cap Rate 2015. Learn all about Kaufman County real estate tax.

Commissioners Approve Budget And Lower Tax Rate Local News Inforney Com

Public Information Kaufman County Emergency Services 6

Part 1 Winning Against A Corrupt Texas Property Tax System By David Watts Jr Medium

Part 1 Winning Against A Corrupt Texas Property Tax System By David Watts Jr Medium

Dashiell Updated Logo 1 4958 Png

Kaufman County Emergency Services 6

Kaufman County Delinquent Property Taxes Information Help Learn How To Apply For Kaufman County Property Tax Loans Tax Ease

City Of Kaufman Permits Form Fill Out And Sign Printable Pdf Template Signnow

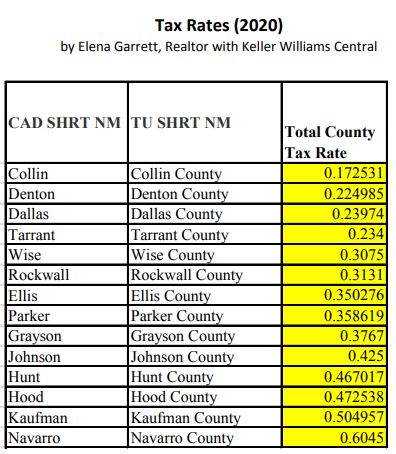

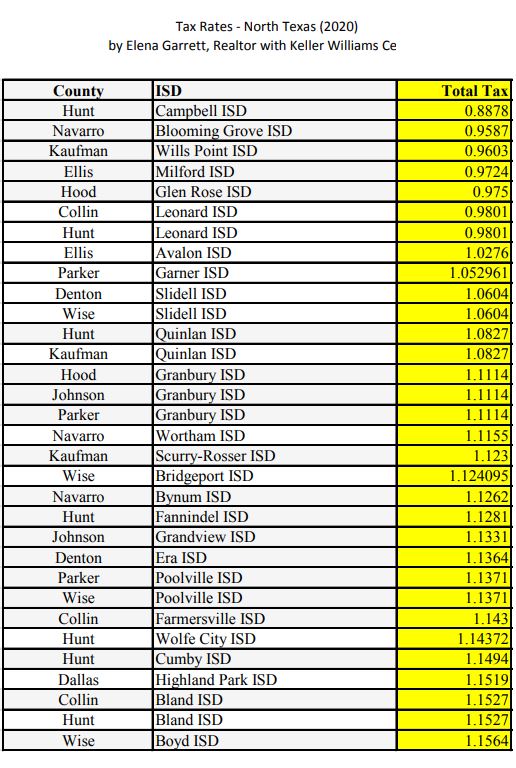

Dfw Tax Property Rates 2020 Elena Garrett Realtor In Dallas Texas My Blog

County Approves Budget Lowers Tax Rate Kaufman County

Property Tax Portal Kern County Ca

Kaufman County Tx News Newsbreak Kaufman County Tx

Dfw Tax Property Rates 2020 Elena Garrett Realtor In Dallas Texas My Blog

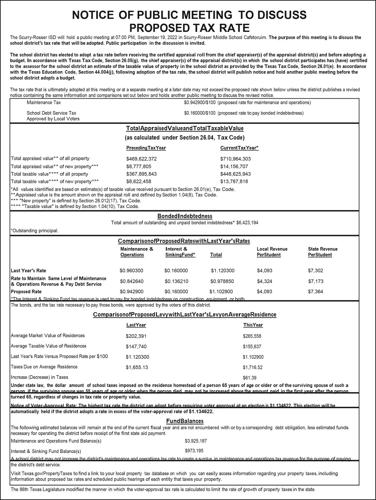

The Scurry Rosser Isd Public Meeting September 19 2022 Around Town Kaufmanherald Com

Tax Increment Reinvestment Zone No 1 City Of Terrell

Census Data Confirms Unprecedented Growth Across Kaufman County Local News Inforney Com